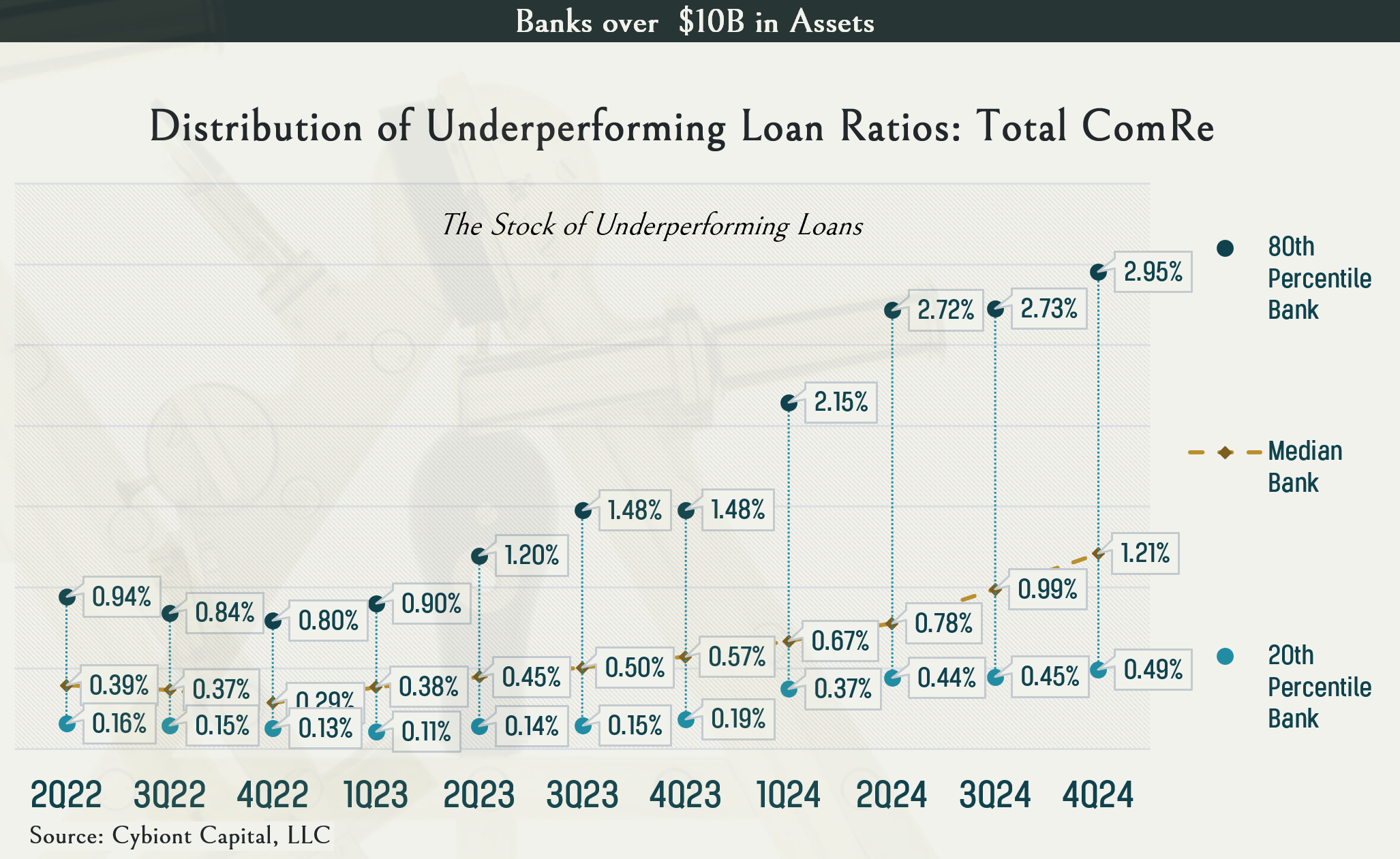

Cybiont: Large Bank Commercial Real Estate (ComRe) Update 4Q24

Each quarter we consider trends in loan quality at publicly traded commercial banks. With all eyes on Commercial Real Estate (ComRe), we present the summary sto... Read more.

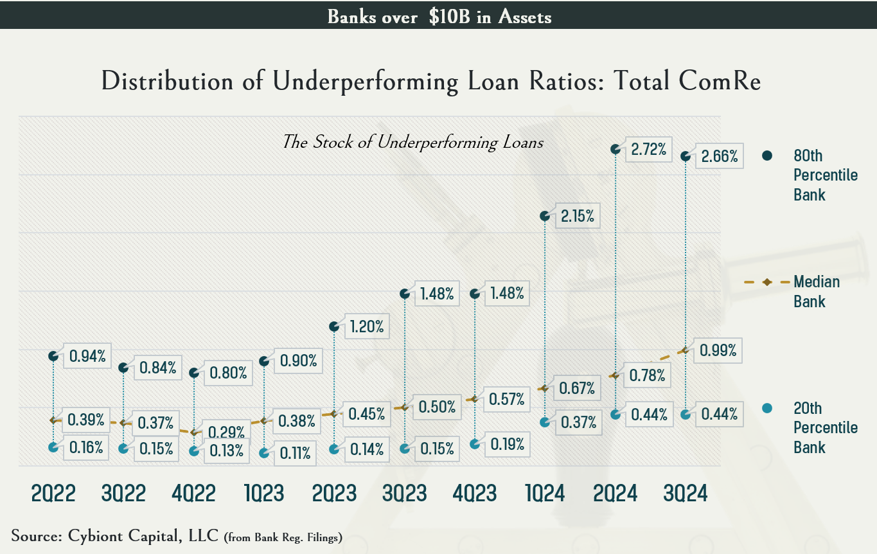

Cybiont: Commercial Real Estate 3Q24 Update

Lower mid-curve rates during the third quarter appear to have slowed loan deterioration in the 3rd quarter of 2024 for most banks with the exception of the medi... Read more.

An Historic Opportunity to Renovate Bank Supervision & Regulation

Inherent Conflicts & Irreconcilable Mandates in Bank Supervision Many expect that the Trump presidency will result in meaningful change to the regulation an... Read more.

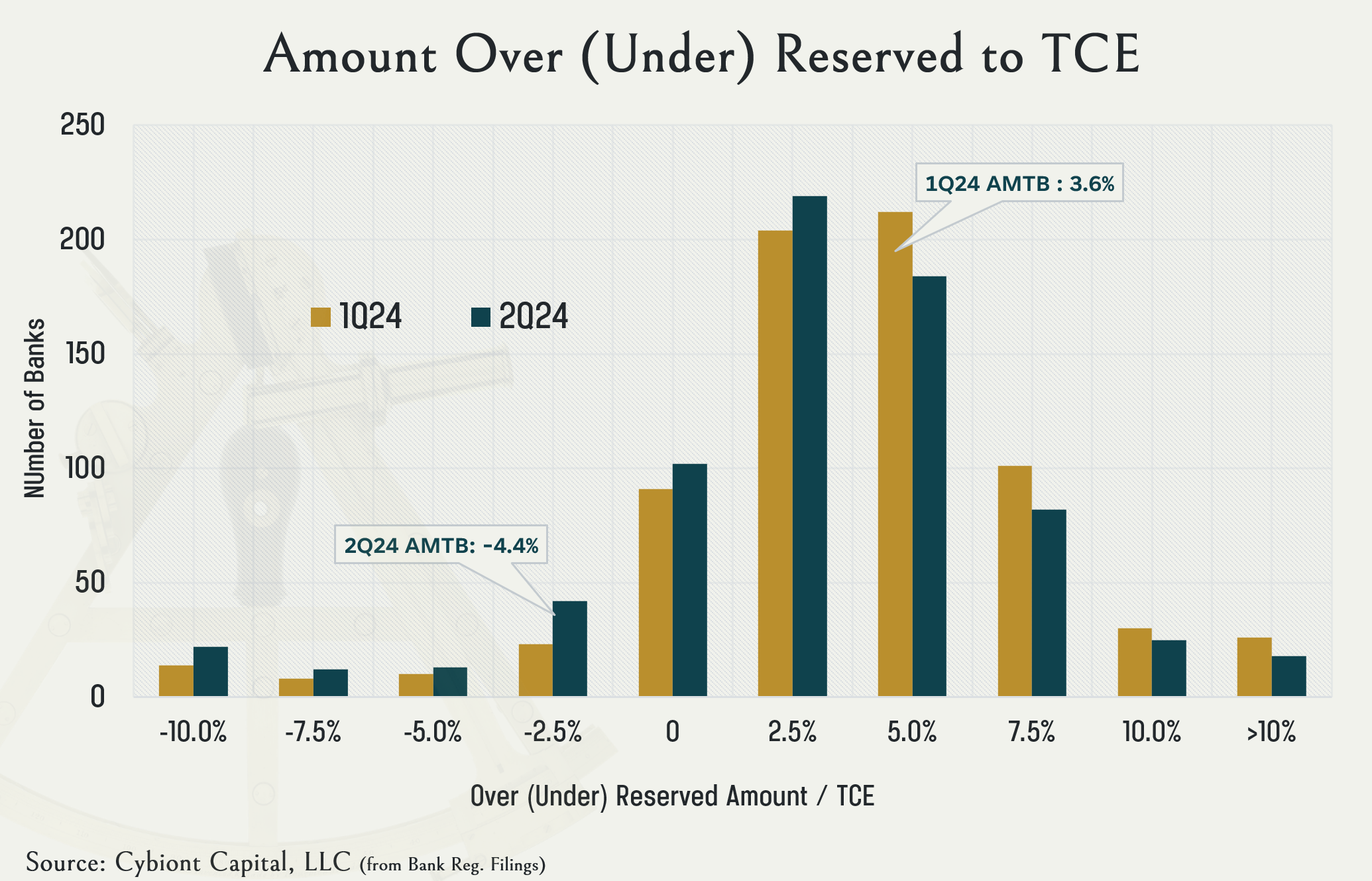

A Closer Look at Amerant Bank’s (AMTB’s) Change in Modeled Reserve Adequacy from the Previous Quarter (1Q24)

Cybiont’s 2Q24 report highlights AMTB's significant shift from over-reserved to under-reserved status, with increased underperforming loans and insufficient p... Read more.

About a quarter of U.S. publicly traded commercial banks have inadequate ACL levels

Cybiont models our expectations for the allowance for credit loss (ACL) levels at publicly traded U.S. banks each quarter. As of 2Q24, our models estimate that ... Read more.

Negative Carry is a Serious “Drag”

The Federal Reserve Bank of San Fransico has estimated that all the pandemic-era excess savings has left the system (see the charts below). It would be nice to ... Read more.

A Quick Look at Compass Point’s March 20, 2024, SoFi Report

First, thanks to Giuliano Bologna for providing the analysis at my request. Second, as I’ve stated in other forums, I respect Giuliano’s capabilitie... Read more.

Cybiont’s Allen Puwalski Joins Board of Flagstar Bank, NA (NYCB) Reuniting Team OneWest, NA

I’m thrilled to announce that I will be joining the board of Flagstar Bank, NA (NYCB). I am excited to reunite with some of the team that transformed Indy... Read more.

What’s Really Happening with Banks’ Commercial Real Estate Loans

Given the precipitous decline in NYCB, many market observers are trying to gauge the extent of deterioration in ComRe books at Regional and Community Banks. Too... Read more.

Cybiont’s 3Q23 Granular View of Bank Credit Quality

Summary of Current Credit Conditions Table 1 shows the level and trend of the stock of underperforming Total Loans over the past year for a consistent universe ... Read more.

Debunking the Short Thesis on SoFi

SoFi stock appears to be the target of a coordinated short seller attack. By this, we mean that we’ve heard similar ideas using similar language that doesn’... Read more.

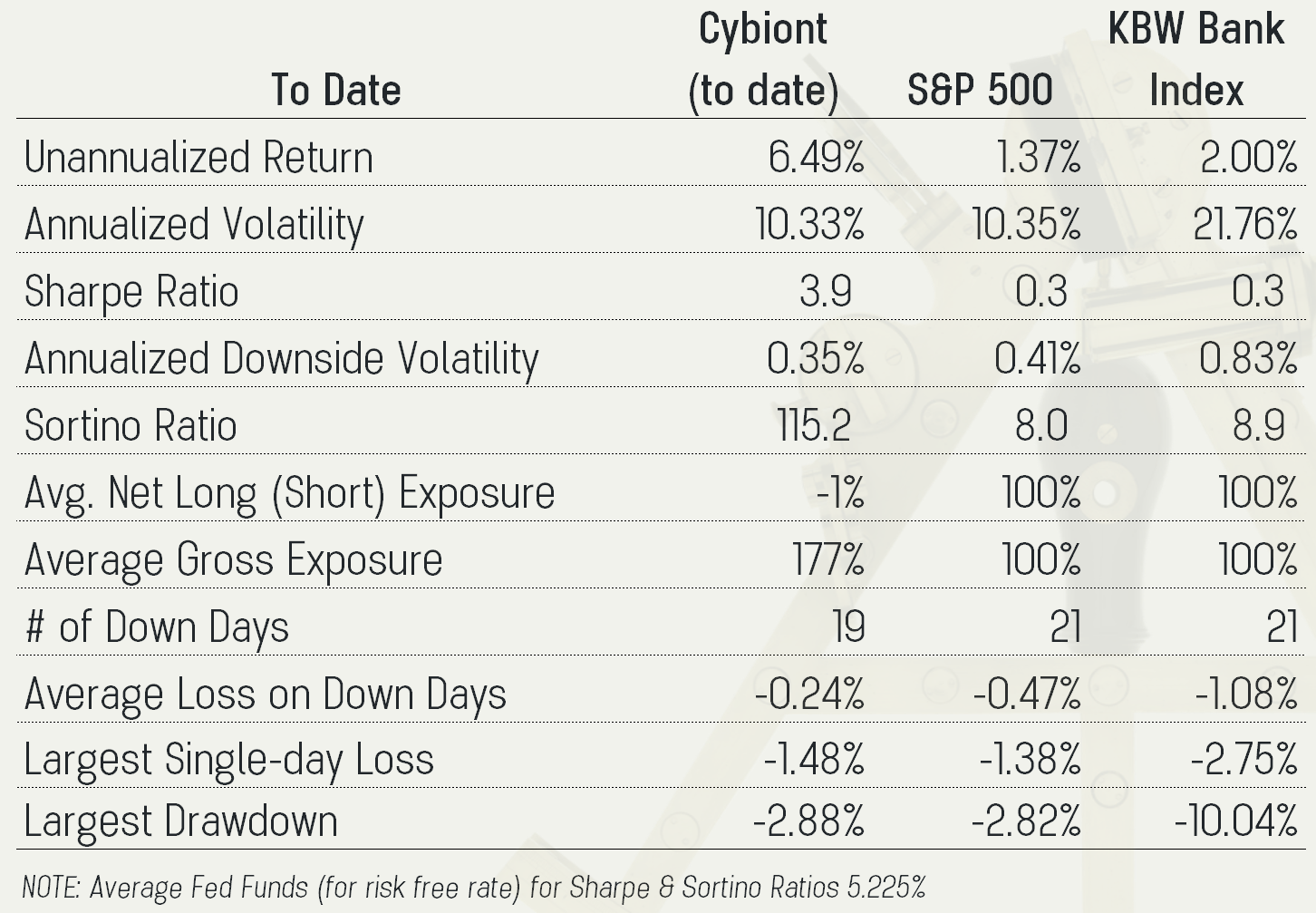

Cybiont’s Long / Short Systematic Portfolio: October 2023 & Performance to Date (4 months)

While our returns were muted for August (roughly break-even), We're thrilled with our nearly 46% annual return to date (compared to the BKX's almost 13% annuali... Read more.

NIM Deterioration Slowed in 3Q23

While it’s a little early (just 69 banks have reported so far), the pace of Net Interest Margin (NIM) contraction appears to be slowing as we had anticipa... Read more.

Cybiont’s Long / Short Systematic Portfolio: September 2023 & Performance to Date (3 months)

While our returns were muted for August (roughly break-even), We're thrilled with our nearly 46% annual return to date (compared to the BKX's almost 13% annuali... Read more.

Cybiont’s Granular View of Bank Credit Quality

Cybiont’s Approach to Credit

Credit quality and the adequacy of loan loss reserves (Alll) are key inputs to our long/short models. On a micro level, they... Read more.

Zion’s Perilous Reach for Yield

Bad Choices at the Wrong Time At some point during the protracted period of record low rates following the global financial crisis (GFC), banks “learned to br... Read more.

Cybiont’s Long / Short Systematic Portfolio: August 2023 & Performance to Date (2 months)

While our returns were muted for August (roughly break-even), We're thrilled with our nearly 46% annual return to date (compared to the BKX's almost 13% annuali... Read more.

Upstart (UPST): A Traditional Non-Prime Unsecured Loan Originator Masquerading as An AI Fintech

High Conviction Short Thesis

Maintaining a sober view of a potentially “disruptive” fintech company is difficult. As investors, we have seen the cycle of... Read more.

Cybiont’s Long / Short Systematic Portfolio

Beginning in July 2023, we are publishing our returns from our $ neutral Long/Short Systematic Portfolio. In brief, this is a rules-driven $ neutral long/short ... Read more.

Upstart (UPST), AI hype, and Credit Underwriting: Update 2

We are reviewing UPST's 10Q, and gaining some clarity...... Read more.

Upstart (UPST), AI hype, and Credit Underwriting: Update 1

UPST reported last night and announced a loan sale wherein the company “invested 40.2M in risk-sharing linked to credit performance.” The biggest si... Read more.

Upstart (UPST), AI hype, and Credit Underwriting.

In theory, there are infinite data sets that can explain why some people default on credit while others pay as agreed. Applying AI to these massive data sets wi... Read more.

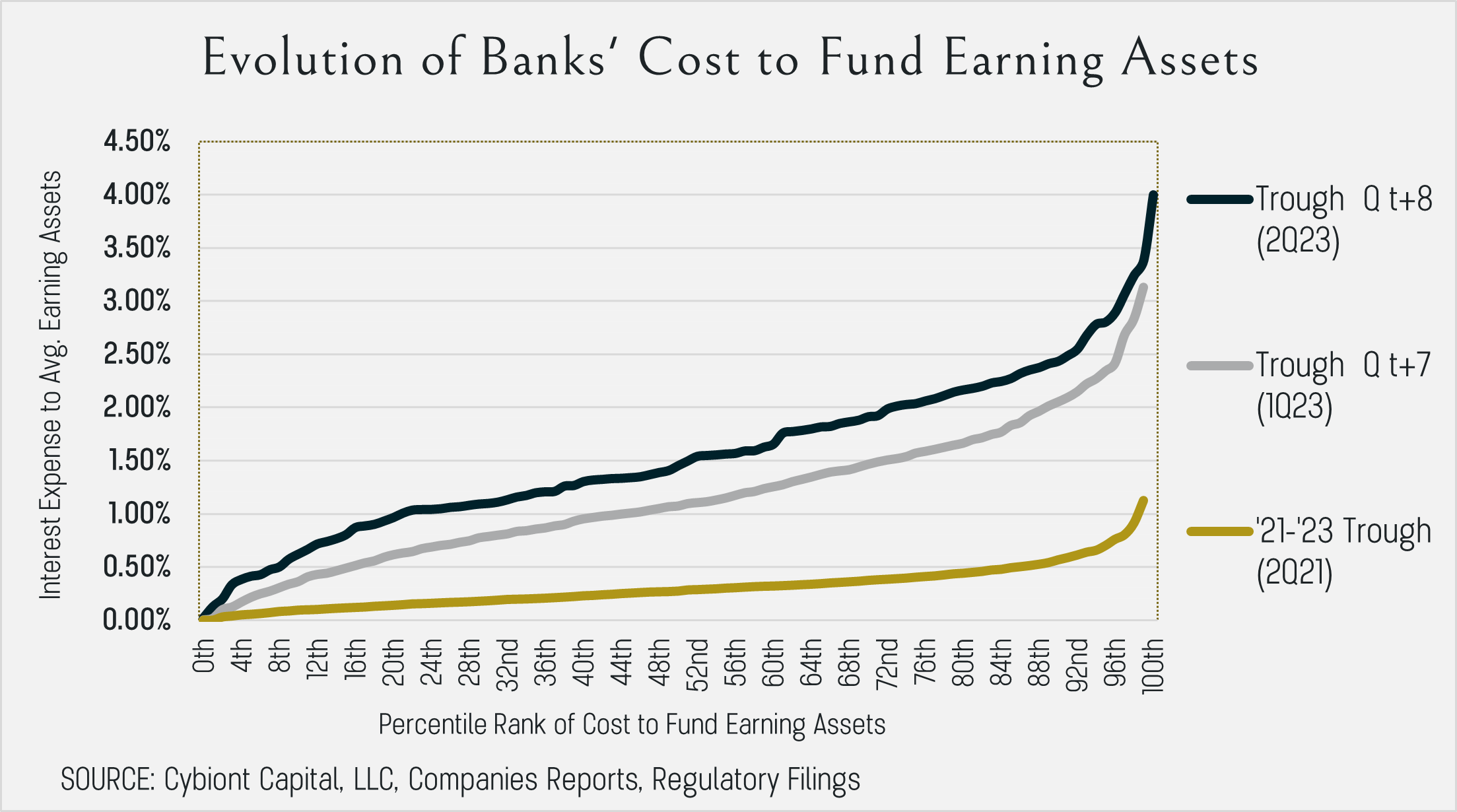

UPDATE: Funding Cost Curve Filling in as Expected

Now that most banks have filed Call Reports (94% of the publicly-traded universe), we are able to update our initial curve from earlier in earnings season. Ther... Read more.

2Q23 Evolution of Bank Funding Costs

So far, 180 publicly traded banks have reported interest expense for 2Q23. While many bank investors are focused strictly on deposit betas, it’s more tell... Read more.

The Fed & Barr’s Capital Proposal: Cybiont’s View

While not exactly “too little, too late,” the outline of the proposal suggests that there is much more relevant and consequential work to be done. F... Read more.

Inherent Conflicts & Irreconcilable Mandates in Bank Supervision (Part 2)

In order to create a bank regulatory and supervisory structure that will improve significantly the stability and smooth functioning of our financial system over... Read more.

An Introduction to Systematic Investing in U.S. Banks

This post is a republication of a paper written several years ago that explores a back test of one of Cybiont’s early models. While our capabilities and p... Read more.

Hedging poor risk management decisions isn’t nearly as effective as avoiding them…

This morning, the WSJ published an article, Few Banks Are Hedging Interest-Rate Risk , about a recent SoCal academic paper on bank hedging activities. I’m... Read more.

This may create a buying opportunity…

FT’s rudimentary screen identifies five banks as particularly “weak.” We’ll see. Each of these banks possesses some mitigating character... Read more.

Banks likely have been “backdating” transfers to HTM, thereby understating unrealized losses in equity.

On page 2 of this quarter’s supplemental instructions for filling out Call Reports (some of my favorite reading…which is yet another reason I strugg... Read more.

Insights from the Sale of SIVB to 1st Citizens, FDIC Loss Understated

It turns out that my initial read on this transaction was likely incorrect. I failed to account for the loss to bond holders in the capital structure. So, altho... Read more.

The composition of funding sources doesn’t bode well for deposit betas in this rate cycle

Banks will likely need to pay up to recompose funding…... Read more.

An Historical Look at Opportunities

...not sure how real this is; but it looks cool.... Read more.

Banks that may no longer be “Well Capitalized”

Concerning the issue of OTTI (It hurts like a UTI; but stands for “other than temporary impairment”): I believe FASB will revisit this concept becau... Read more.

Cybiont’s view

Here’s how we see the investment opportunity unfolding…... Read more.

Inherent Conflicts & Irreconcilable Mandates in Bank Supervision (Part 1)

Part 1: Our Muddled Supervisory System This series of articles won’t primarily be about how we ended up with the current bank dislocation. For the elevator su... Read more.

Cybiont Capital is…

Allen Puwalski Chief Investment Officer and Co-portfolio Manager Allen started his career over 30 years ago as a bank examiner and capital markets specialist fo... Read more.

You must be logged in to post a comment.